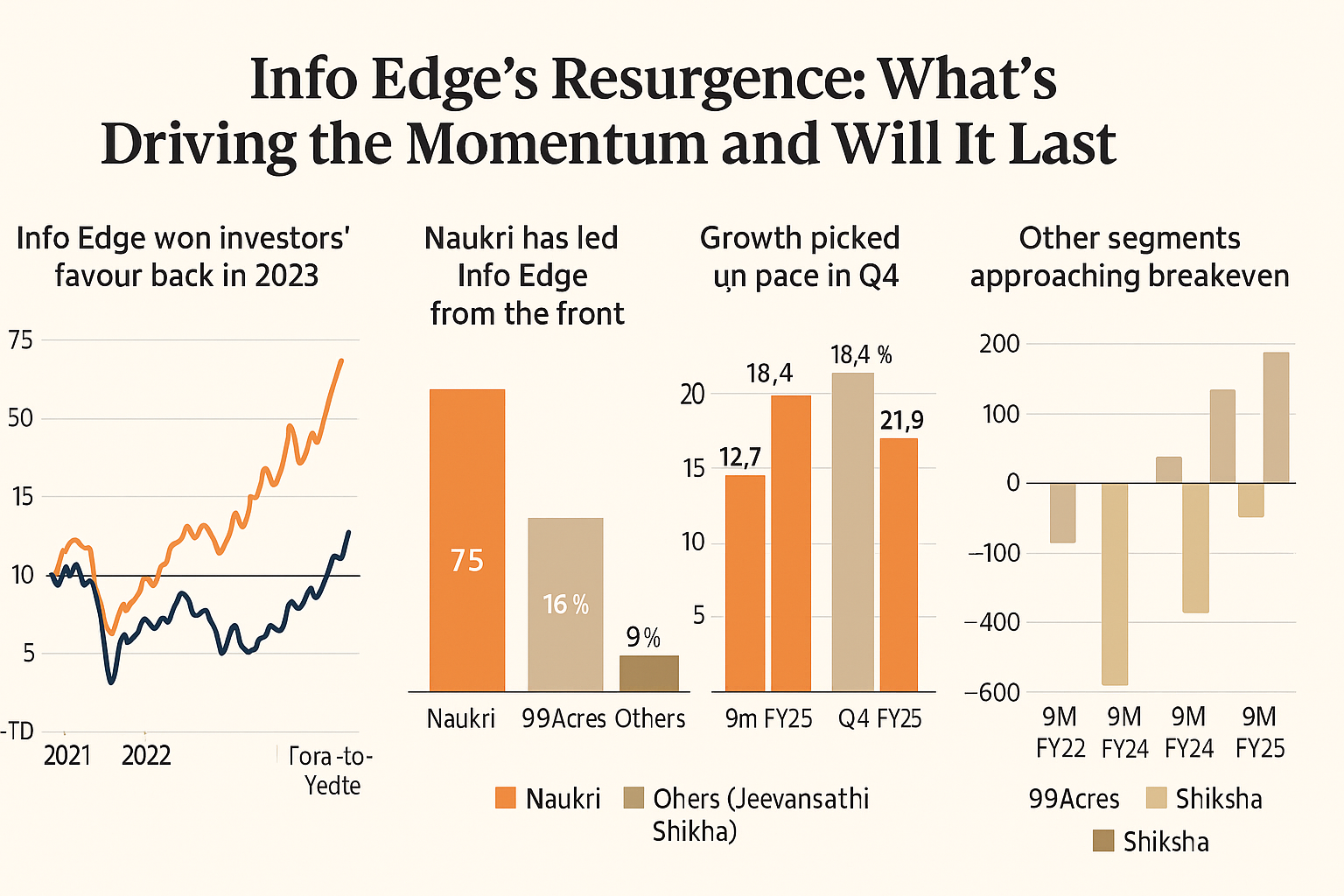

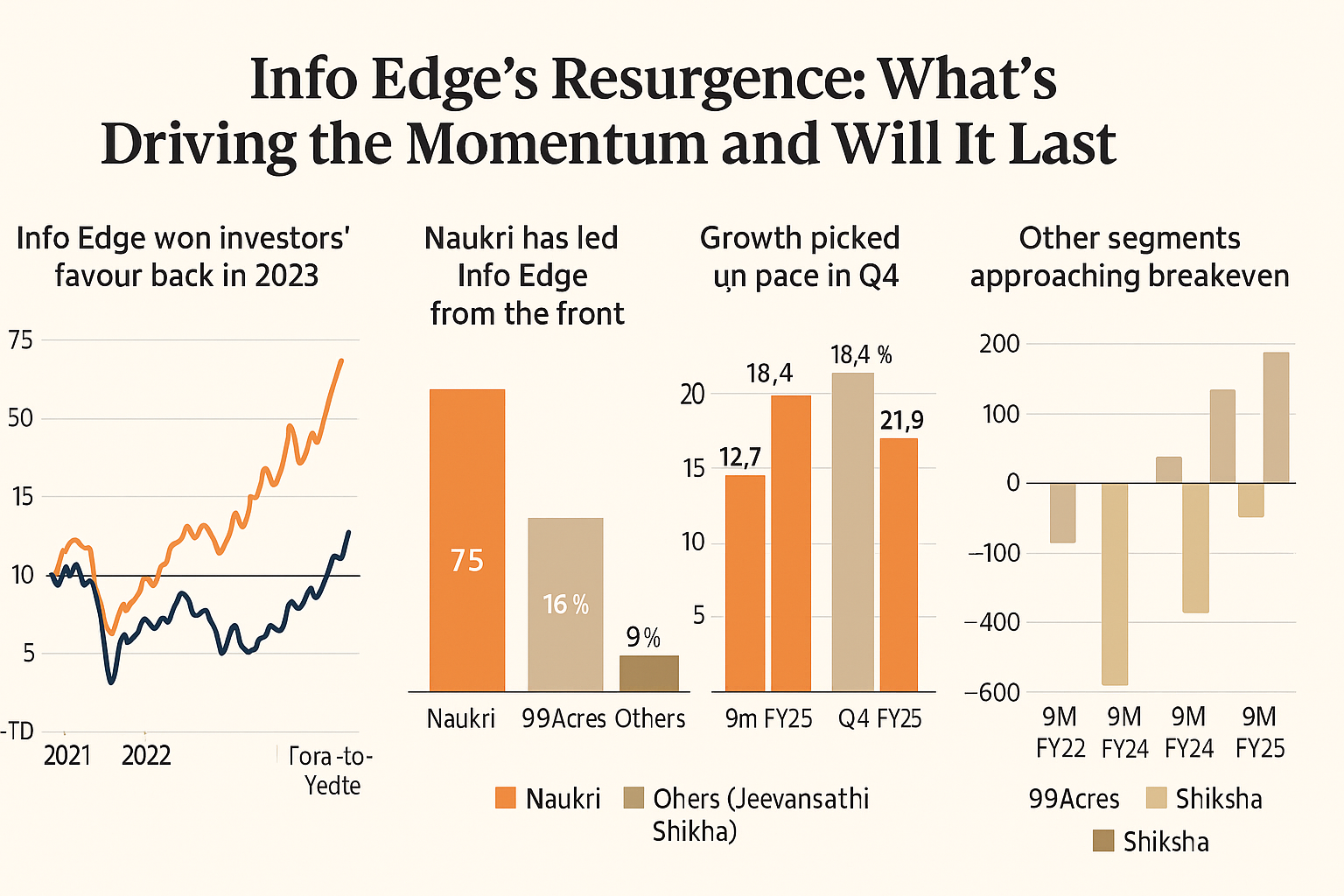

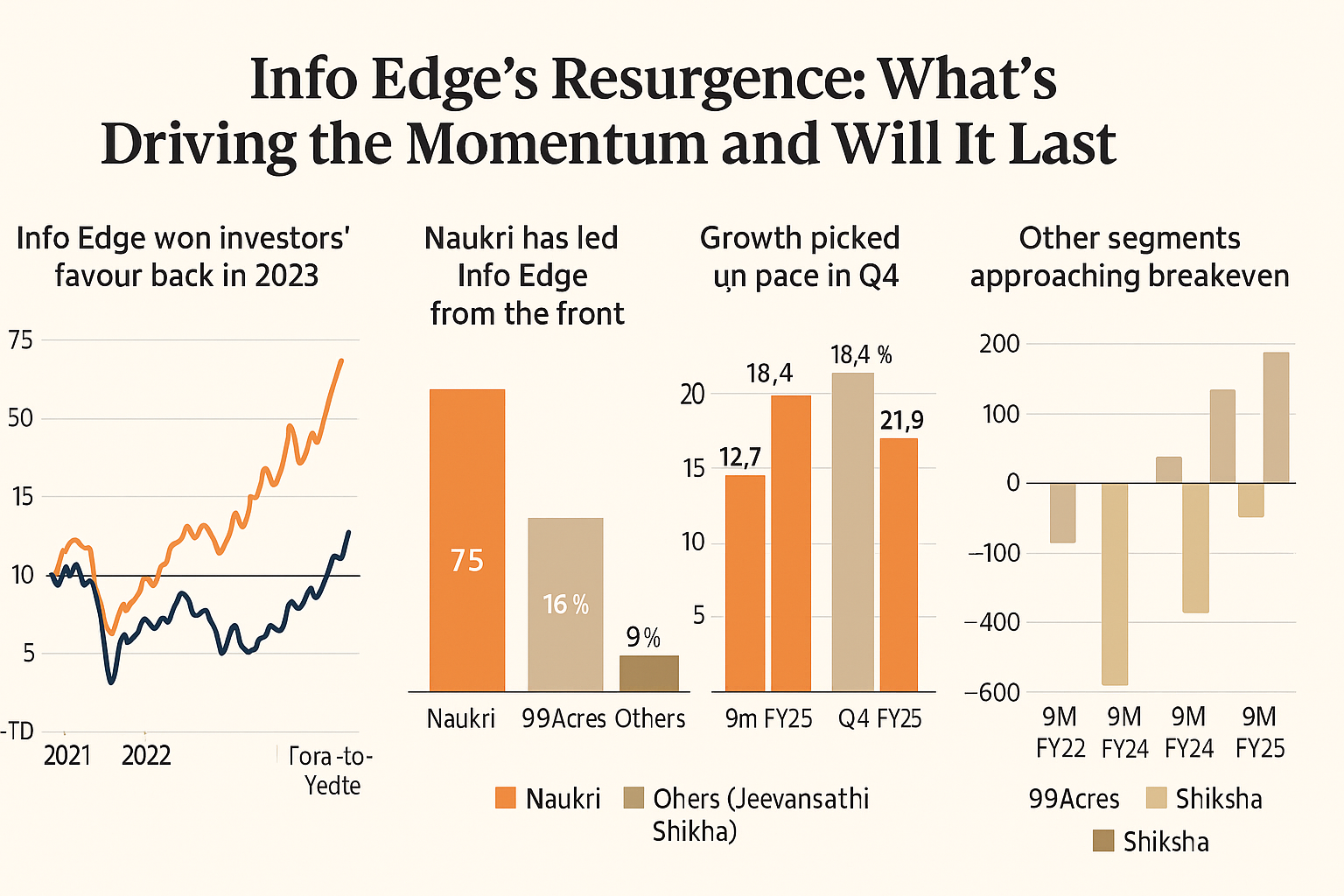

Info Edge, India’s leading internet classifieds player, has once again become the toast of the investor community. Following a stellar Q4 update on April 8, 2025, the stock surged more than 10%, continuing its outperformance of the broader IT index—a trend that began in 2023. The company’s portfolio of businesses, spanning recruitment, real estate, matrimony, and education, coupled with strategic investments in tech startups, has positioned it as a compelling long-term story.

Naukri: The Crown Jewel in Info Edge’s Portfolio

Info Edge’s core recruitment portal, Naukri.com, continues to be the company’s primary revenue driver, contributing 75% to its FY25 billings. Its dominance is underlined by its unmatched scale—over 104 million resumes and more than half a million job listings. Averaging 19,500 resume uploads daily, Naukri commands a 75% market share in the job search space, far outpacing competitors like Monster, Shine, and Indeed (excluding LinkedIn).

From FY21 to FY25, Naukri has clocked a 27% CAGR in billings, showcasing both resilience and adaptability. Its diversification away from an IT-heavy revenue model—shrinking the IT share from 49% in FY22 to 45% by Dec 2024—has cushioned the impact of sectoral slowdowns. Non-IT segments such as BFSI and Infrastructure are now key growth levers.

The platform benefits from a powerful network effect: more traffic leads to more jobs, more applications, and ultimately, more employers. This self-reinforcing loop has helped Naukri retain its leadership in both scale and profitability. Operating on an asset-light model with negative working capital and no debt, Naukri boasts industry-leading operating profit margins—59% as of Q3 FY25.

99Acres: Turning the Corner

99Acres, Info Edge’s second-largest vertical, contributes 16% to billings and has emerged as a promising growth engine. Riding the wave of increased digital adoption in real estate marketing, 99Acres now commands a 40% share of overall real estate search traffic, ahead of rivals like MagicBricks and Housing. Its user engagement, measured by lower bounce rates and higher interaction time, has improved significantly.

Operationally, 99Acres has reduced its operating losses and cash burn by 67% and 63%, respectively, in 9MFY25. With better digital marketing efficiency and analytics-led monetization, breakeven is firmly in sight.

Matrimony and Education: A Mixed Bag

Jeevansathi has seen a dramatic turnaround. With a 36% jump in billings and tightened marketing expenses, its cash outflows dropped 89% in 9MFY25. The segment is on track to break even, even amid stiff competition in the online matrimony space.

In contrast, Shiksha—the EdTech arm—continues to underperform, reflecting broader struggles in the education technology sector. Though it only accounts for 5% of FY24 revenues, its sustained losses temper the otherwise bullish outlook for Info Edge.

Broad-Based Growth Accelerates in Q4

The Q4FY25 results were a defining moment. Overall billings grew 19% YoY—outpacing the 13.7% growth in the first nine months. Naukri led with 18.4% growth, up from 12.7% earlier. 99Acres followed with 21.9% growth in Q4, up from 14.5%. This surge across segments cements Info Edge’s strong execution capabilities and the secular strength of its business model.

Strategic Investments: A Silent Value Engine

Beyond its operating businesses, Info Edge’s strategic and financial investments have emerged as a massive value contributor. With stakes in 111 companies, including unicorns like Zomato and PolicyBazaar, Info Edge has transformed ₹4,000 crore worth of investments into a ₹36,855 crore portfolio. This translates to a gross IRR of 36%, contributing 30-40% to the company’s overall valuation.

The joint Alternate Investment Fund (AIF) with Temasek Holdings underscores the company’s long-term vision and venture acumen. Notably, its ₹1,075 crore investment in Zomato and PolicyBazaar is now valued at over ₹31,500 crore.

Risks on the Horizon

While the outlook remains robust, Info Edge is not without challenges. Naukri remains vulnerable to prolonged weakness in the IT sector, its primary revenue source. Although the temporary truce in the US-China trade war is promising, any downturn in global tech hiring could dent its growth trajectory.

In real estate, the residential market—comprising over 80% of 99Acres’ listings—is showing signs of fatigue. New project listings grew only 9% YoY in Q3, lagging the 20% growth in resale and rental segments. A prolonged slowdown in housing could impact 99Acres’ momentum.

Moreover, sustained losses in Shiksha and potential value corrections in its startup portfolio due to macro volatility warrant cautious optimism. The upcoming Q4 earnings and updates on these fronts will be critical to watch.

Conclusion: A Stock to Watch, With Eyes Wide Open

Info Edge has orchestrated a remarkable comeback, driven by leadership in recruitment, rising momentum in real estate, and prudent capital allocation through strategic investments. While risks remain, especially in IT hiring and residential real estate, the company’s diversified business mix and operating discipline provide a strong foundation. If it can sustain its broad-based growth and continue unlocking value from its investments, 2025 could very well be another defining year for Info Edge.

Info Edge, India’s leading internet classifieds player, has once again become the toast of the investor community. Following a stellar Q4 update on April 8, 2025, the stock surged more than 10%, continuing its outperformance of the broader IT index—a trend that began in 2023. The company’s portfolio of businesses, spanning recruitment, real estate, matrimony, and education, coupled with strategic investments in tech startups, has positioned it as a compelling long-term story.

Info Edge, India’s leading internet classifieds player, has once again become the toast of the investor community. Following a stellar Q4 update on April 8, 2025, the stock surged more than 10%, continuing its outperformance of the broader IT index—a trend that began in 2023. The company’s portfolio of businesses, spanning recruitment, real estate, matrimony, and education, coupled with strategic investments in tech startups, has positioned it as a compelling long-term story.

Info Edge, India’s leading internet classifieds player, has once again become the toast of the investor community. Following a stellar Q4 update on April 8, 2025, the stock surged more than 10%, continuing its outperformance of the broader IT index—a trend that began in 2023. The company’s portfolio of businesses, spanning recruitment, real estate, matrimony, and education, coupled with strategic investments in tech startups, has positioned it as a compelling long-term story.

Info Edge, India’s leading internet classifieds player, has once again become the toast of the investor community. Following a stellar Q4 update on April 8, 2025, the stock surged more than 10%, continuing its outperformance of the broader IT index—a trend that began in 2023. The company’s portfolio of businesses, spanning recruitment, real estate, matrimony, and education, coupled with strategic investments in tech startups, has positioned it as a compelling long-term story.