India’s banking sector, once revving at high speed, appears to have taken its foot off the accelerator in FY25. The country’s largest lender, State Bank of India (SBI), along with peers like Kotak Mahindra Bank, reported slower credit growth, signaling a cautious shift in lending strategy. With FY25 behind us, the mood across the banking sector is one of prudence rather than pursuit. So, what’s behind this measured deceleration, and how is FY26 likely to shape up?

SBI: Missing the Mark on Credit Growth

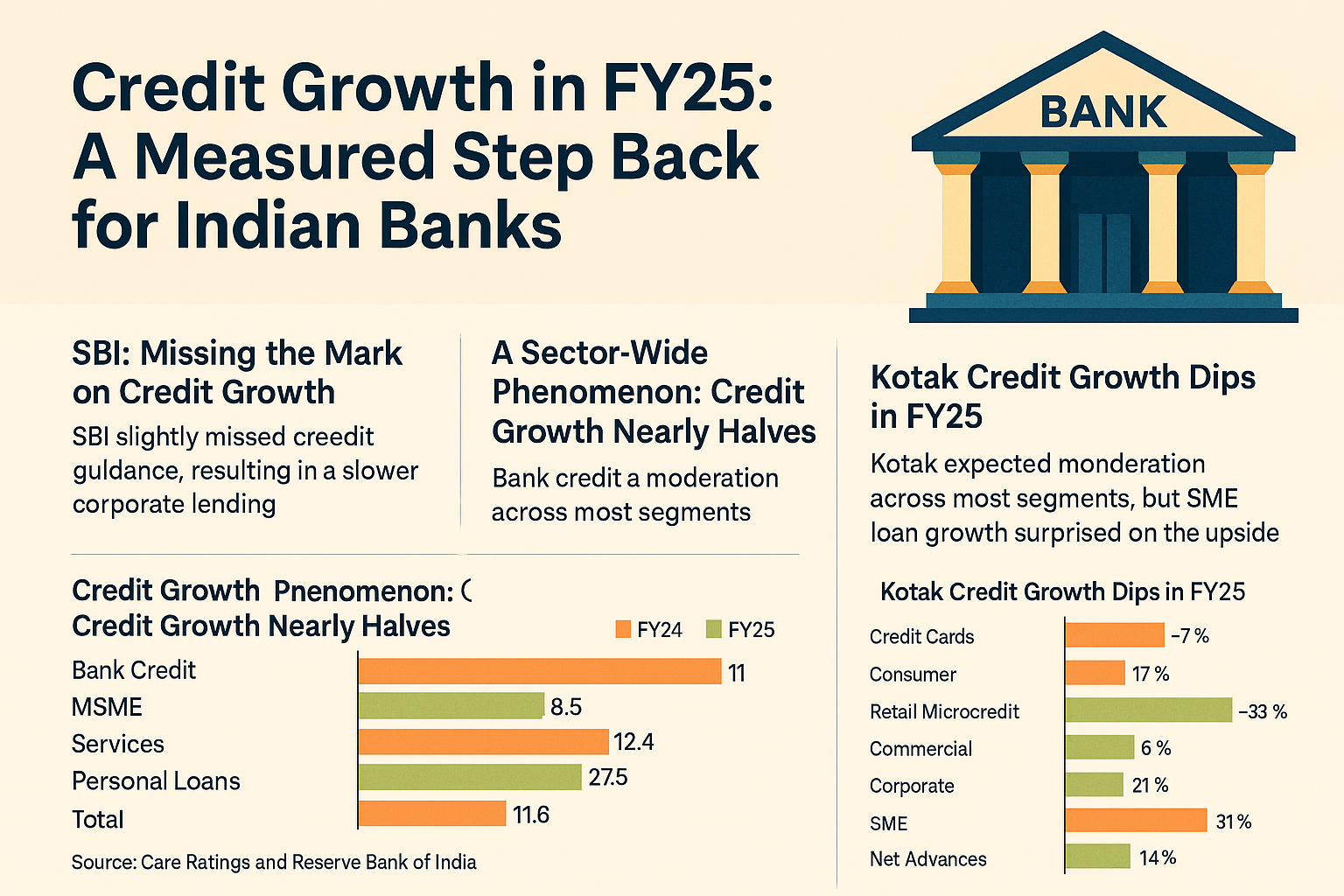

SBI, the bellwether of India’s banking sector, reported a 12% increase in total advances in FY25, falling short of its own guidance of 14% and marking a decline from 15% growth in FY24. The slowdown was particularly stark in corporate lending, which grew by just 9%, compared to 16.2% in FY24. Retail personal loans, agri, and SME segments also saw moderated growth.

A major factor contributing to this underperformance was the unexpected slowdown in corporate credit demand and a surge in prepayments, especially by public sector undertakings. NTPC’s ₹10,000 crore public issue, for example, allowed it to deleverage, reducing the need for bank credit.

Despite the sluggish year, SBI remains optimistic about FY26. With a ₹3.4 trillion credit pipeline—half of which is already sanctioned—and demand reviving in sectors like infrastructure, renewables, and commercial real estate, the bank anticipates 12-13% growth in advances.

Kotak Mahindra Bank: A Quiet Performer

Kotak Mahindra Bank recorded 14% growth in advances, a decline from 18% the previous year. Despite outperforming its peers in relative terms, the moderation was felt across its portfolio. Consumer loan growth slowed to 17% from 20%, while credit card loans plunged 7%, reversing a massive 44% surge in FY24.

The drag came largely due to the RBI’s restrictions on onboarding new customers, including a temporary 10-month ban on credit card issuance. Although lifted in February 2025, the impact lingered through FY25.

Interestingly, while corporate and commercial loans saw sharp slowdowns, Kotak’s SME portfolio surged 31%, reflecting strategic refocusing. The bank plans to lean on retail and SME lending to spur growth in FY26, aiming for 1.5-2x nominal GDP credit expansion.

A Sector-Wide Phenomenon: Credit Growth Nearly Halves

SBI and Kotak’s performance mirrors a broader industry trend. According to the Reserve Bank of India, total bank credit growth dropped from 20% in FY24 to 11% in FY25. This halving was not just numerical but structural.

Key Contributing Factors:

- High Base Effect: FY24’s 20% growth—led by a boom in unsecured lending—set a high benchmark.

- Credit-to-Deposit Ratio Pressure: The ratio surpassed 75%, prompting banks to prioritize deposit mobilization over lending.

- NBFC Stress: Lending to NBFCs had surged until FY24, leading the RBI to hike risk weights in November 2023. This curbed bank lending to the sector until the rollback in February 2025.

With unsecured lending tapering off and large NBFCs pulling back, bank credit growth moderated across retail, SME, and corporate segments.

Peer Snapshot: HDFC, ICICI, Axis

Among other major players:

- HDFC Bank: Posted modest 5.4% growth in advances.

- Axis Bank: Grew by 8%, indicating continued caution.

- ICICI Bank: Bucked the trend slightly, clocking 13.3% growth, outperforming most peers.

The systemic deceleration underscores a sector-wide recalibration in the face of rising risks and tightening liquidity.

Financial Health: Profitability and Margins

- SBI reported a 16% jump in net profit to ₹70,901 crores, aided by improved cost-to-income ratio, though net interest income (NII) grew by just 4.4%.

- Kotak’s NII rose 9%, but net profit stayed flat at ₹13,720 crores due to an 87% spike in provisions. Its net interest margin declined by 36 basis points to 4.96%.

While margins contracted for both banks, asset quality remained stable, thanks to better underwriting and selective lending.

Market Valuations: Caution Reflected

- SBI trades at a PB multiple of 1.4—well below peers like ICICI (3.3), HDFC Bank (2.9), and Kotak (2.6).

- Kotak trades at a steep discount to its historical median valuation of 4.2, reflecting recent growth headwinds.

However, Kotak’s superior return on assets (RoA) supports a relatively higher valuation than SBI, despite recent challenges.

Outlook for FY26: Gradual Optimism

FY26 may not usher in a return to the heady days of FY24, but green shoots are visible. Tax reliefs, a stable rate environment, and revived demand in sectors like infrastructure and renewables could lend support to a slow but steady rebound in credit growth.

Banks like SBI and Kotak are recalibrating their strategies—focusing more on retail, SME, and salaried segments, while maintaining a cautious stance on corporate and unsecured lending.

Overall, the sector is transitioning from a phase of exuberant growth to one of measured expansion. For stakeholders, FY26 promises to be a year of consolidation and cautious optimism.