After nearly two years of regulatory hurdles and market anticipation, Vedanta Ltd has finally crossed the most critical checkpoint in its ambitious restructuring journey. The National Company Law Tribunal’s (NCLT) approval for the demerger of Vedanta into five separately listed entities marks not just a procedural win, but a defining moment in billionaire Anil Agarwal’s effort to reshape one of India’s largest natural resources conglomerates. The market reaction was swift and enthusiastic, pushing the stock to fresh record highs and reigniting debate on whether this move will truly unlock value or simply rearrange the balance sheet.

The NCLT Verdict: Ending a Chapter of Delays

The NCLT’s order clears Vedanta’s plan to split its India operations into five companies, decisively rejecting objections raised by the ministry of petroleum and natural gas. The government had alleged misrepresentation of oil and gas assets and insufficient disclosure of liabilities, concerns that had repeatedly delayed the restructuring.

In its ruling, the tribunal found the demerger to be fair, lawful, and not against public interest. It also dismissed claims of non-disclosure, noting that Vedanta had shared all required information and secured overwhelming approval—more than 99.9%—from shareholders and creditors. With this, the most significant regulatory overhang has been removed, allowing Vedanta to move forward after months of uncertainty.

Market Cheers the Decision

Investors wasted no time in expressing their approval. Vedanta shares surged 3.5% on the day of the NCLT order to close at ₹569.35 on the BSE, followed by another 2% rise the next day to hit an all-time high of ₹580.45. The rally reflects renewed confidence that the long-promised restructuring may finally translate into clearer business narratives and sharper valuations.

What Happens Next: The Road to March 2026

With tribunal approval in hand, the focus now shifts to execution. Vedanta must approach stock exchanges, seek their approvals, and announce a record date. On this date, existing shareholders will become eligible to receive shares in each of the new companies.

The mechanics are straightforward: for every share of Vedanta Ltd held, shareholders will receive one share in each of the five demerged entities. These companies will then be listed and traded independently on the stock exchanges. While Vedanta has guided March 2026 as the completion target—already a year later than its original plan—analysts believe the process may spill over by just a month or two, if at all.

Meet the Five New Vedanta Companies

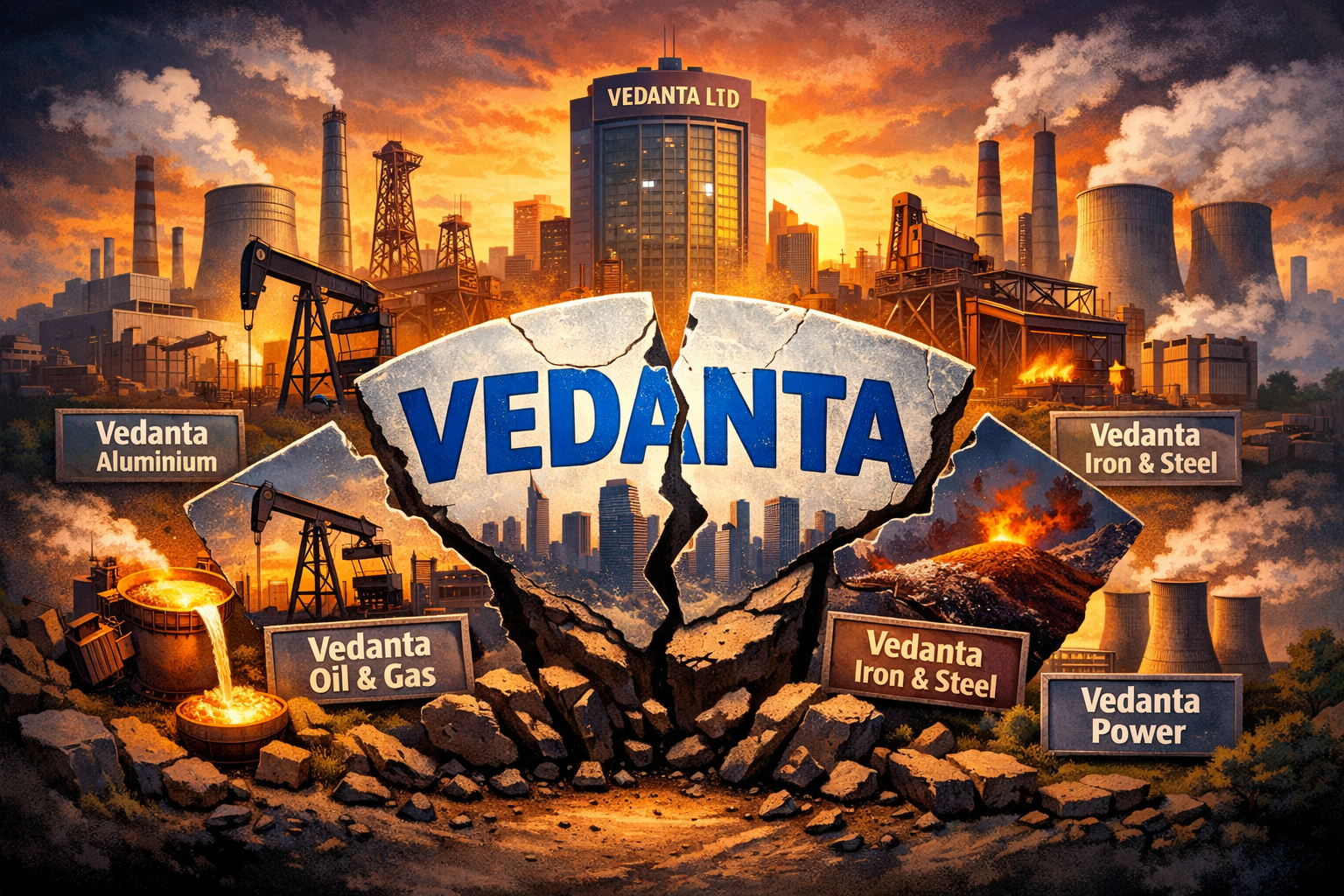

The demerger will transform Vedanta from a diversified giant into five sector-focused businesses:

- Vedanta Ltd (Flagship): The holding company will retain stakes in Hindustan Zinc, Sterlite Copper, and international assets such as Zinc International and Konkola Copper Mines.

- Vedanta Aluminium: Housing the aluminium business and refining operations, this entity will represent India’s largest aluminium producer.

- Vedanta Oil & Gas: This company will absorb Cairn India’s oil and gas exploration and production assets, including its key Rajasthan fields.

- Vedanta Iron and Steel: Comprising the steel business under ESL Limited and iron ore mining operations.

- Vedanta Power: Encompassing the merchant power business, including the Talwandi Sabo power plant in Punjab.

Each of these entities is designed as a pure-play, allowing investors to directly bet on individual sectors rather than the conglomerate as a whole.

The Debt Question: The Real Monitorable

Perhaps the most critical factor for investors is how Vedanta’s substantial debt—around ₹66,000 crore—will be divided. Analysts expect the aluminium business to shoulder the largest burden, roughly ₹30,000 crore, given its strong cash generation. The flagship Vedanta Ltd is likely to take on about ₹20,000 crore, supported by dividends from Hindustan Zinc.

The remaining debt is expected to be split among Iron and Steel (₹4,500 crore), Oil & Gas (₹4,000 crore), and Power (₹7,000 crore). How comfortably each company manages this leverage will play a decisive role in shaping investor sentiment post-listing.

Why Vedanta Chose to Demerge

When the plan was first announced in 2023, Vedanta positioned the demerger as a value-unlocking exercise. By simplifying its structure and creating independent, sector-focused companies, the group aimed to attract targeted investors, enable faster decision-making, and potentially facilitate partnerships, joint ventures, or asset monetisation.

As Anil Agarwal put it then, separating the businesses would unlock value and accelerate growth in each vertical—an argument that resonates with markets accustomed to rewarding clarity and focus.

Analyst Views: Incremental, Not Transformational

Despite the market rally, not all analysts are convinced this is a game-changer. Some see the NCLT approval as an incremental step rather than a transformational event. According to this view, the restructuring alone may not create outsized value unless it leads to tangible outcomes such as asset monetisation, strategic investments, or improved capital allocation.

Takeaways: A Structural Reset, With Execution Risks

Vedanta’s demerger has finally moved from promise to process. The NCLT’s approval removes the biggest roadblock and sets the stage for one of the most significant corporate restructurings in India’s resources sector. For investors, the opportunity lies in clearer business models and potential re-rating of pure-play entities. The risk, however, remains in execution—particularly around debt allocation and post-listing performance.

As the countdown to March 2026 begins, the real test for Vedanta will not be in splitting itself apart, but in proving that the sum of the parts is indeed greater than the whole.

Feel free to share your experiences and insights in the comments below. Let’s continue the conversation and grow together as a community of traders and analysts.

By sharing this experience and insights, I hope to contribute to the collective knowledge of our professional community, encouraging a culture of strategic thinking and informed decision-making.

As always, thorough research and risk management are crucial. The dynamic nature of financial markets demands vigilance, agility, and a deep understanding of the tools at your disposal. Here’s to profitable trading and navigating the election season with confidence!

Ready to stay ahead of market trends and make informed investment decisions? Follow our page for more insights and updates on the latest in the financial world!

For a free online stock market training by Yogeshwar Vashishtha (M.Tech IIT) this Saturday from 11 am – 1 pm, please sign up with https://pathfinderstrainings.in/training/freetrainings.aspx

Experience profits with my winning algo strategies – get a free one-month trial with ₹15 lakh capital! – https://terminal.algofinders.com/algo-terminal

Disclaimer

This article should not be interpreted as investment advice. For any investment decisions, consult a reputable financial advisor. The author and publisher are not responsible for any losses incurred by investors or traders based on the information provided.