The Meteoric Rise

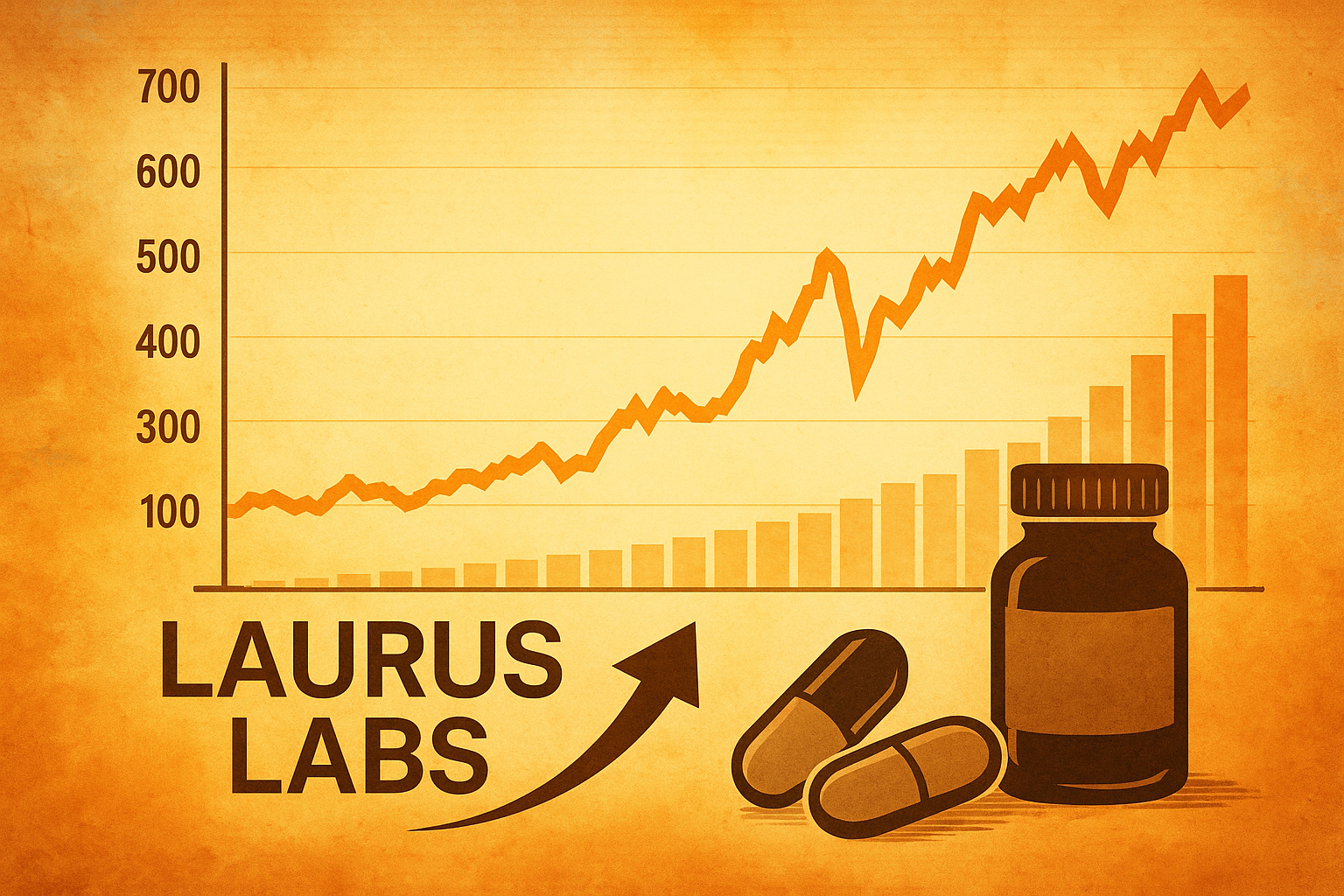

In the aftermath of the global health crisis, a relatively obscure pharma player stunned markets. Laurus Labs’ stock multiplied tenfold between March 2020 and August 2021, surging from ₹68 to an all-time high of ₹724. This remarkable ascent was rooted in an equally staggering fourfold profit jump—from ₹255 crore in FY20 to ₹984 crore in FY21.

Behind this explosive growth was a surge in demand for antiretroviral (ARV) drugs during the pandemic, where Laurus, armed with pre-pandemic manufacturing expansion, capitalised on the opportunity. Revenue from ARV APIs nearly doubled year-over-year, while its market share in the global ARV formulations space hit 33%. The company’s operating margins expanded to 32%, and asset turnover rose, driving profitability and stock price to historic highs.

Retail enthusiasm also soared—public shareholding jumped fivefold. However, as is often the case with meteoric rallies, domestic institutions booked profits, slashing their holdings from over 31% to just under 4%.

The Painful Fall

What followed was a sharp correction. As the pandemic-driven demand waned and earnings normalised, Laurus’ stock plummeted 60% from its peak by March 2023. Profits dropped to ₹162 crore in FY24, with margins nearly halved. The once-prized ARV portfolio lost steam, its revenue share falling to 46% by FY25. The asset-heavy expansion, once a boon, began to bite back. With underutilised capacity, Laurus suffered from operating deleverage.

Still, cracks revealed the company’s intent. While profitability fell, gross margins held relatively steady—suggesting the core business retained its strength. What was once a reactive pandemic beneficiary was now transitioning into a forward-looking, diversified enterprise.

A Strategic Pivot: CDMO in the Spotlight

Recognising the risks of a pandemic-dependent portfolio, Laurus launched a ₹3,200 crore capex cycle between FY22-FY25, targeting CDMO (contract development and manufacturing organisation) services and emerging technologies such as cell and gene therapy. Approximately 74% of this capex was channeled toward APIs and CDMO, with the rest to drug product capabilities.

Though initial underutilisation weighed on margins, FY25 marked a turning point. CDMO revenues surged 49% to ₹1,374 crore, lifting its contribution to 25% of total revenue. In contrast, generics revenue inched up just 2%. Laurus’ operating margin rebounded to 20%, and net profits more than doubled to ₹358 crore.

Key financials began to recover:

- Revenue: ₹5,554 crore (up 10%)

- Operating margin: 20% (up 400 bps)

- RoCE: Rebounded from 6% to 10%

- RoE: Doubled from 4% to 8%

Building a Future-Ready Pipeline

Laurus is not merely shifting gears—it’s redesigning the engine. By March 2025, it was handling over 110 active CDMO projects, mostly in advanced clinical stages, indicating high near-term monetisation potential. Notably, it also has over 15 commercialised projects, and revenue scale-ups are expected through FY26.

CDMO facility ramp-up is still underway, with just 32% capacity fully online. Yet, the trajectory looks promising. Asset turnover improved to 0.83x (from 0.77x mid-year), and the company expects to regain the 1.1x range by FY27.

The management is targeting a long-term revenue contribution of 50% from CDMO by FY30—up from 25% currently. If execution keeps pace, this transition may redefine Laurus Labs’ valuation narrative.

Beyond CDMO: Biotech and Therapies in the Mix

In biotechnology, Laurus aims to double its fermentation capacity by 2026-end. Its client base has already expanded by 1.5x over the past year.

In gene therapy, a ₹128 crore GMP facility is under construction to support plasmid, vector, and antibody-drug conjugation development.

Meanwhile, its associate firm ImmunoACT is advancing in the cell therapy space. Phase I trials for a CAR-T therapy (NexCAR19) are complete, with a 2,500-treatment capacity facility set to go live by Q2FY26. Revenues from this segment will flow through direct hospital sales, adding a new dimension to Laurus’ long-term story.

Generics: Steady, But Not the Growth Driver

While generics remain the revenue backbone (₹4,020 crore in FY25), the real growth is expected in the non-ARV portfolio from Q3FY26. ARV sales are projected to remain flat over the next few years, with minimal impact from potential US HIV aid cuts.

What Lies Ahead?

Laurus Labs stands at a critical inflection point. The worst of its earnings slump appears behind it. As its CDMO pipeline matures and margins expand, it’s transitioning from a COVID-era outperformer to a long-term compounder in the contract manufacturing and biotech space.

Yet, challenges persist. Much of the new capacity is still under-utilised. Biotech and gene therapy revenues remain distant. And the stock isn’t cheap—trading at 108x P/E, far above sector averages.

In short, Laurus Labs is no longer a one-theme ARV story. It’s morphing into a diversified pharma-tech play. The stock’s resurgence may still have legs—provided execution matches the ambition.

Feel free to share your experiences and insights in the comments below. Let’s continue the conversation and grow together as a community of traders and analysts.

By sharing this experience and insights, I hope to contribute to the collective knowledge of our professional community, encouraging a culture of strategic thinking and informed decision-making.

As always, thorough research and risk management are crucial. The dynamic nature of financial markets demands vigilance, agility, and a deep understanding of the tools at your disposal. Here’s to profitable trading and navigating the election season with confidence!

Ready to stay ahead of market trends and make informed investment decisions? Follow our page for more insights and updates on the latest in the financial world!

For a free online stock market training by Yogeshwar Vashishtha (M.Tech IIT) this Saturday from 11 am – 1 pm, please sign up with https://pathfinderstrainings.in/training/freetrainings.aspx

Experience profits with my winning algo strategies – get a free one-month trial with ₹15 lakh capital! – https://terminal.algofinders.com/algo-terminal

Disclaimer

This article should not be interpreted as investment advice. For any investment decisions, consult a reputable financial advisor. The author and publisher are not responsible for any losses incurred by investors or traders based on the information provided.