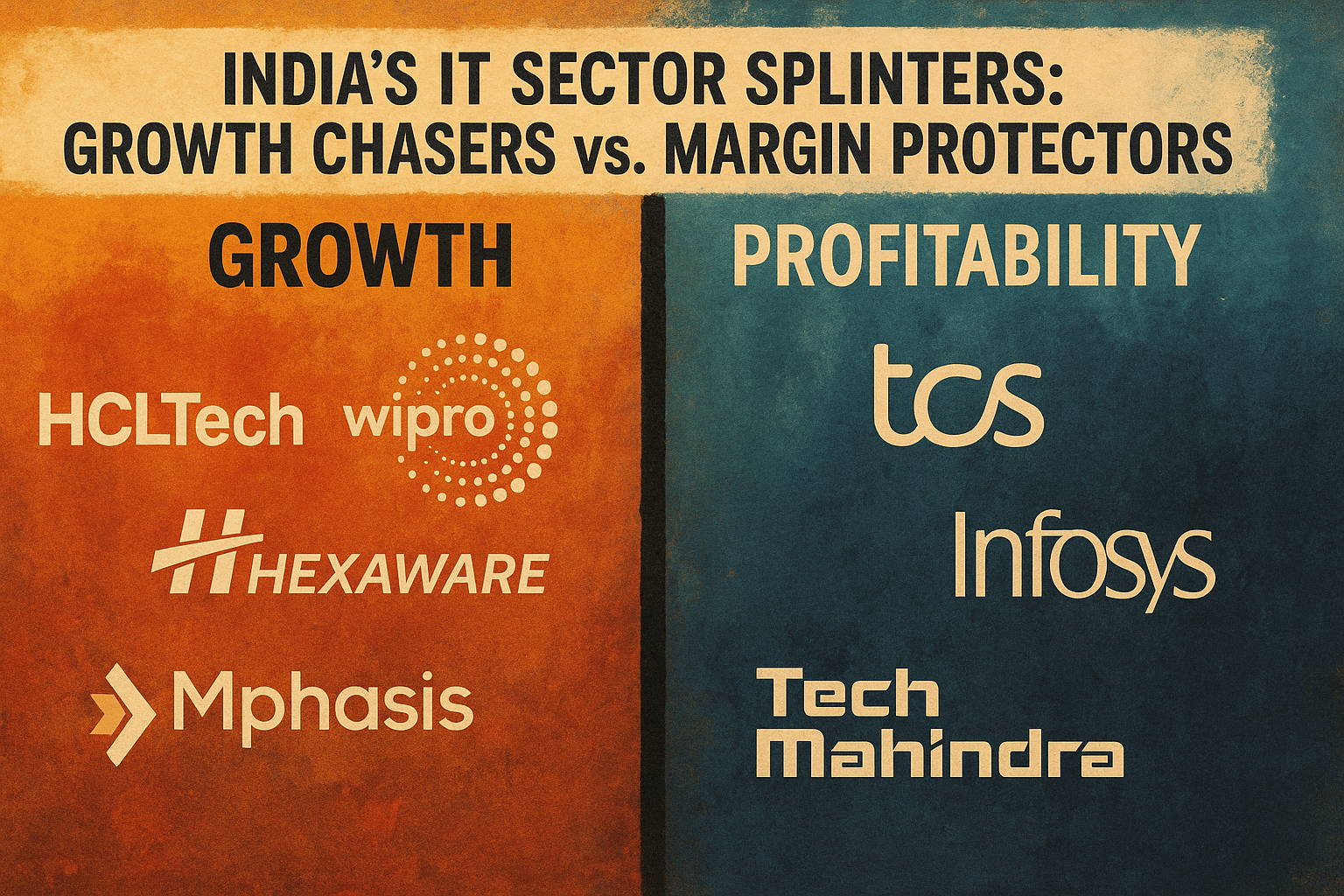

India’s $283-billion information technology (IT) industry is at a turning point, splitting into two distinct blocs: those prioritizing growth through large deal wins and those doubling down on profitability and margin protection. The divide has been sharpened by the twin forces of AI-led automation and global macroeconomic uncertainty, which have made clients simultaneously more demanding and cautious.

Growth at Any Cost: HCLTech, Wipro, Mphasis, and Hexaware

Several firms are consciously trading profitability for scale.

- HCLTech lowered its operating margin guidance to 17–18%, down from 18–19%, signaling flexibility to grab more deals even at the cost of earnings. Analysts note this is the second margin cut in four years, reflecting a clear growth-first strategy.

- Wipro, under CEO Srini Palia, has secured nearly $8 billion worth of large deals in a year. CFO Aparna Iyer emphasized that upfront investments in mega deals would depress margins in the near term but fuel long-term expansion.

- Mphasis reported 4.43% revenue growth with a margin uptick to 15.3%, with CEO Nitin Rakesh stressing that holding onto growth as a “North Star” remains their strategic direction.

- Hexaware achieved a 13.7% revenue rise to $1.43 billion, with CEO Ramakarthikeyan Srikrishna openly acknowledging that the company is ready to sacrifice margins if required to secure big wins.

The Guardians of Profitability: TCS, Infosys, and Tech Mahindra

Larger incumbents are tightening their belts to preserve investor trust in stable earnings.

- TCS remains steadfast in its 26–28% long-term margin target, though last year it reported 24.3%. Recently, it announced a 2% workforce reduction focused on middle and senior management to curb costs amid AI-driven client price pressures.

- Infosys is attempting a balanced approach—pursuing growth while defending profitability. Its recent acquisitions and careful margin management reflect this dual play.

- Tech Mahindra is executing a three-year roadmap to raise margins from 9.7% to 15% by FY27. The company has committed to $250 million in annual cost savings, deliberately avoiding acquisitions to focus on efficiency.

Why the Divergence?

Analysts see AI as the central disruptor. Clients now demand up to 30% price discounts, as automation slashes delivery costs. This forces IT vendors into a stark choice: either chase AI-led mega deals for future relevance or protect margins to reassure shareholders.

- Phil Fersht of HFS Research observes that bigger firms like TCS, Infosys, and Tech Mahindra are under shareholder pressure to maintain profitability.

- Mid-tier players, on the other hand, see transformational deals as an opportunity to alter their market position, even if it comes with thinner margins.

- Thomas Reuner of PAC notes that providers are “between a rock and a hard place,” facing delayed market recovery, geopolitical uncertainty, and client demands for both AI acceleration and cost reduction.

The Road Ahead

This fragmentation suggests India’s IT sector may no longer move in unison. Instead, two clear models are emerging:

- The Growth Bloc – Firms betting big on mega deals, scaling fast, and accepting near-term margin pressures (HCLTech, Wipro, Mphasis, Hexaware).

- The Profitability Bloc – Giants prioritizing investor confidence, efficiency, and steady margins (TCS, Infosys, Tech Mahindra).

As AI rewrites the outsourcing playbook, this divergence is expected to widen. The industry’s future will likely be shaped by whether firms choose to be builders of future growth or guardians of current profitability.

Would you like me to also create a visual illustration for this post—something like a split-frame graphic showing the two blocs (Growth vs. Profitability) with company logos under each? That could make it more engaging for your readers.

Feel free to share your experiences and insights in the comments below. Let’s continue the conversation and grow together as a community of traders and analysts.

By sharing this experience and insights, I hope to contribute to the collective knowledge of our professional community, encouraging a culture of strategic thinking and informed decision-making.

As always, thorough research and risk management are crucial. The dynamic nature of financial markets demands vigilance, agility, and a deep understanding of the tools at your disposal. Here’s to profitable trading and navigating the election season with confidence!

Ready to stay ahead of market trends and make informed investment decisions? Follow our page for more insights and updates on the latest in the financial world!

For a free online stock market training by Yogeshwar Vashishtha (M.Tech IIT) this Saturday from 11 am – 1 pm, please sign up with https://pathfinderstrainings.in/training/freetrainings.aspx

Experience profits with my winning algo strategies – get a free one-month trial with ₹15 lakh capital! – https://terminal.algofinders.com/algo-terminal

Disclaimer

This article should not be interpreted as investment advice. For any investment decisions, consult a reputable financial advisor. The author and publisher are not responsible for any losses incurred by investors or traders based on the information provided.