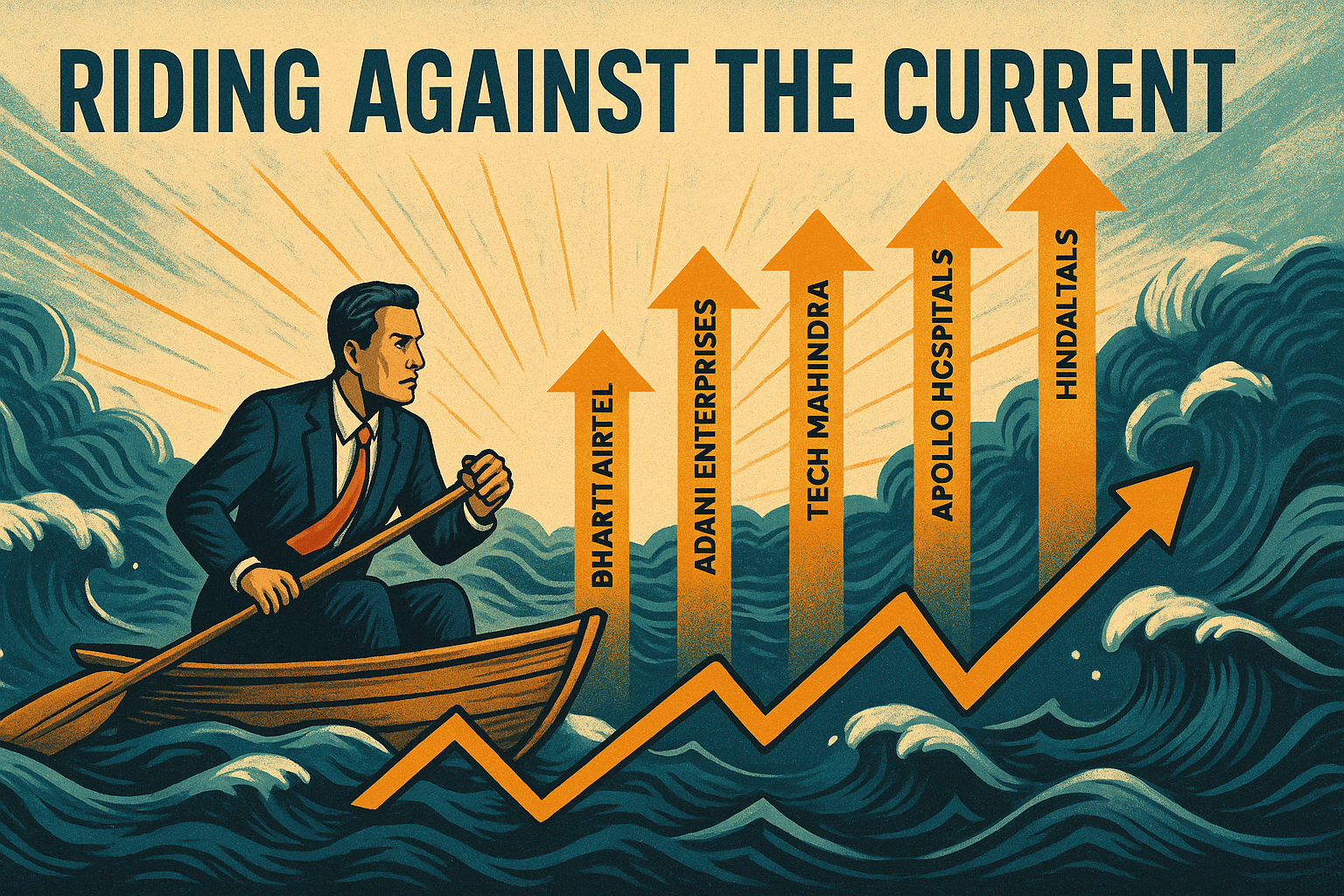

In a year where corporate India has been battered by economic headwinds, five companies—Bharti Airtel, Adani Enterprises, Tech Mahindra, Apollo Hospitals, and Hindalco—have bucked the trend with strong earnings growth and a focus on sustainable profitability. Amid tepid consumption, volatile inflation, geopolitical tremors, and sector-specific drag, these outliers offer a compelling look into the levers of resilience.

Bharti Airtel: Profit Powerhouse Amidst Heavy Debt

EPS Growth: 346% YoY

FY25 EPS: ₹58.85 vs ₹13.20 in FY24

Revenue: ₹1.73 lakh crore (+15.3% YoY)

Net Margin: 21.7% (vs 5.7%)

Bharti Airtel has emerged as a standout in the telecom space, thanks to robust execution and a favorable revenue mix. A sharp uptick in other income has supercharged EPS growth, while higher ARPU and rising adoption of premium digital services have propelled revenues both in India and Africa.

However, Airtel’s mammoth ₹2.12 lakh crore debt casts a long shadow. Management is betting on deleveraging and lower capex in FY26 to shore up free cash flow. Strategic alliances (Apple TV, Starlink) and a push into data centers and broadband suggest strong long-term positioning.

Outlook: Despite its debt overhang, Airtel’s 5-year CAGR of 31% in net profit and an RoE of 28.34% paint the picture of a fundamentally strong telecom behemoth primed for pricing power and digital dominance.

Adani Enterprises: Leaner, Meaner—But Watch the Valuations

EPS Growth: 117% YoY

FY25 EPS: ₹61.62 vs ₹28.42

Revenue: ₹97,895 crore (+1.5% YoY)

Debt: ₹91,819 crore

P/E Ratio: 66x

While top-line growth was muted, Adani Enterprises saw a profitability boost from a one-off ₹3,286 crore post-tax gain via stake sale in AWL Agri Business. Strong margin expansion and efficient operations underline the group’s strength in executing large infrastructure bets.

The company’s aggressive capex plan—₹1.3–1.7 lakh crore annually over five years—is bold, but raises questions about financing, especially with cash reserves of only ₹6,962 crore and a debt-to-equity ratio nearing 2x.

Caveat: Ongoing regulatory scrutiny (DoJ, SEC, Sebi) and high valuations could weigh on investor sentiment. Yet, if asset monetisation remains on track, Adani Enterprises may continue to surprise.

Tech Mahindra: Margin Revival Amid IT Blues

EPS Growth: 79.9% YoY

Revenue: ₹52,988 crore (+1.9% YoY)

Operating Margin: 13% (vs 9%)

Deal Wins: $2.7 billion (+42.5% YoY)

Tech Mahindra’s FY25 story is one of smart cost control and operational discipline. Despite sluggish IT spending and geopolitical drag in key markets, the company clawed back profitability with a 400 bps margin improvement.

Over the longer term, Tech Mahindra has underperformed peers like TCS and Infosys in RoE and revenue growth, but its strong deal momentum and renewed focus on core verticals may help close the gap.

Next Horizon: FY27 targets include 15% EBIT margin and RoCE over 30%. Execution on these goals, in a weak demand environment, will be crucial to sustaining investor confidence.

Apollo Hospitals: Healthy Returns, Heavy Lifting

EPS Growth: 61% YoY

Revenue: ₹21,794 crore (+14.3%)

Operating Margin: 14%

Capex Plan: ₹8,000 crore for 4,300 beds over 3–4 years

Apollo continues to thrive amid rising demand for organized healthcare and specialized services. The Apollo 24/7 platform, diagnostics push, and premium pricing have supported revenue and margin growth. With internal accruals funding the bulk of its expansion, the company’s ₹1,000 crore annual FCF acts as a strong buffer.

That said, its 0.96x debt-to-equity is higher than sector averages, adding an element of financial risk as it embarks on a major expansion spree.

Strategic Edge: With high RoE (19.1%) and RoCE (17.1%), Apollo is deploying capital wisely. Margin discipline and growth from digital health are likely to remain key value drivers in FY26.

Hindalco: Metals Giant with Global Reach

EPS Growth: 57.6% YoY

Revenue: ₹2.38 lakh crore (+10.4%)

Net Profit: ₹16,002 crore (record high)

Debt-to-Equity: 0.52x

Hindalco posted a stellar year, with margin expansion across both aluminium and copper verticals. Aided by better input costs and favorable demand, especially via its Novelis subsidiary, the company is now focused on quadrupling downstream EBITDA by FY30.

Securing coal from the Bandha mine for its Mahan smelter ensures raw material stability, while robust internal accruals are expected to fund capex of ₹7,500–8,000 crore for FY26.

Risk Watch: U.S. aluminium tariffs could disrupt Novelis’ supply chain, but management is confident about cost pass-through mechanisms. With RoCE at 15.2% and a strong balance sheet, Hindalco is poised for continued growth.

Conclusion: What Sets These Outliers Apart

Each of these companies has played to its strengths—be it Airtel’s monetisation of digital infrastructure, Adani’s aggressive portfolio churn, Tech Mahindra’s operational reset, Apollo’s scale-focused healthcare model, or Hindalco’s global downstream strategy.

Common threads among them include:

- Margin expansion despite revenue plateaus

- Disciplined capital deployment

- Strategic pivots or asset monetisations

- Outperformance amid sectoral drag

Yet, sustainability is the key question. These companies now face the delicate task of balancing growth ambition with fiscal prudence, valuation with earnings visibility, and regulatory oversight with market trust.

FY26 may well separate those with one-off windfalls from those with enduring fundamentals. For investors and analysts alike, the next year will test not just the numbers—but the narratives.

Feel free to share your experiences and insights in the comments below. Let’s continue the conversation and grow together as a community of traders and analysts.

By sharing this experience and insights, I hope to contribute to the collective knowledge of our professional community, encouraging a culture of strategic thinking and informed decision-making.

As always, thorough research and risk management are crucial. The dynamic nature of financial markets demands vigilance, agility, and a deep understanding of the tools at your disposal. Here’s to profitable trading and navigating the election season with confidence!

Ready to stay ahead of market trends and make informed investment decisions? Follow our page for more insights and updates on the latest in the financial world!

For a free online stock market training by Yogeshwar Vashishtha (M.Tech IIT) this Saturday from 11 am – 1 pm, please sign up with https://pathfinderstrainings.in/training/freetrainings.aspx

Experience profits with my winning algo strategies – get a free one-month trial with ₹15 lakh capital! – https://terminal.algofinders.com/algo-terminal

Disclaimer

This article should not be interpreted as investment advice. For any investment decisions, consult a reputable financial advisor. The author and publisher are not responsible for any losses incurred by investors or traders based on the information provided.